Is Refinancing the Solution to Headache-Inducing Student Loans? Here’s the Lowdown

College may be the key to a better future but with the rising cost of education, many hopefuls are doubtful if it’s still worth it. After all, the mounting student loans can make it hard to focus on the real goal: get a high-paying job and save up for retirement.

Now that you are already in the workforce and are finding it hard to pay up that significant amount of loan, you may have considered refinancing. But before you jump into it, here are things you should ponder on:

Better Credit Score

A high credit score may be hard to achieve but is useful

There’s not a doubt that you’re already a grown-up (read: you pay your own bills), which means credit score is everything. This is your rating from 0 to 850 which marks your credibility to repay what you owe – in short, it’s what lenders use to gauge your ability to pay your loan back.

Basically, it’s hard to refinance when you have a credit score of 600 and below, so once your grade improves, you are entitled to do this. It makes sense because you may get a better interest rate now than your previous loan.

High-Interest Rate for Private Loan

Why do you need to refinance in the first place? The goal is to secure a lower interest rate from a new loan, which means you are merely wishing to save more by cutting additional expenses.

A ballooning interest for a private loan is a pain

So if you’re currently suffering from a loan with a high-interest rate, then refinancing may be your best option. It is also worth considering if you have a private loan since you won’t lose borrower’s protection that is effective on federal loans, too.

Low Monthly Due

It is burdensome to pay huge sums every month, so naturally, you want to lower your monthly payment. But with refinancing, it’s not as simple as it sounds.

Yes, a lender typically carries your loan from the other lender by paying for it, but that comes with a price. While your new loan has a lower interest, it has a new scheme, and usually, your payment period starts from the beginning.

Do you want to have smaller monthly payments?

For example, if you pay on time and in full every month, you can pay off your loan in 10 years with your original lender. However, if you decide to refinance this, you are entitled to have a lower interest rate but the time resets – so no matter how long you have been paying, you’ll need to adhere to a new term.

You know what this means: paying for a longer period means more money to shell out. In the end, it is better to weigh your priorities: is paying smaller amounts every month better than paying more in the long run?

More in Lifestyle

-

`

Billionaire Mark Cuban Has Learned More from His Failures Than Success, Proving It’s Okay to Make Mistakes

Shark Tank fans must know Mark Cuban as the casually-dressed billionaire who gained his massive fortune and financial success from wise...

March 29, 2020 -

`

Before the Glitz and Glamour: Yolanda Hadid’s Rough Past Will Inspire You To Persevere

Long before supermodels Gigi and Bella Hadid dominated runways, their mother Yolanda was the first to have carved her name in...

March 28, 2020 -

`

As Government Enforces Lockdown, 800,000 Businesses in UK at Risk of Going Under

The COVID-19 pandemic has been the biggest blow to the economy since the 2008 recession, and many fear that its effects will...

March 18, 2020 -

`

An Economic Recession is Around the Corner, Here Are 2 Ways You Can Protect Your Wealth

No one had anticipated at the beginning of the year that 2020 would be so rough. From the Australian wildfires to...

March 18, 2020 -

`

These Celebrities Earn Millions Despite Retiring from Hollywood, But How?

While being a celebrity usually comes with million-dollar paychecks, fame is not forever. No wonder, a lot of actors and musicians...

March 8, 2020 -

`

This Gas Station Chain is Making Money Through Unique Ways and Here’s What Entrepreneurs Can Learn from It

There are plenty of business advice to be found both online articles and published books. But there’s nothing quite like seeing...

March 8, 2020 -

`

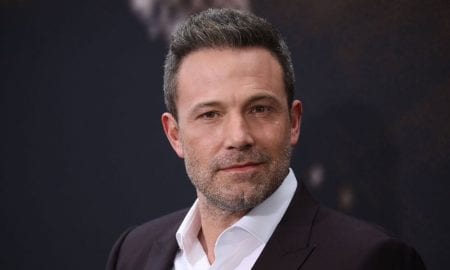

Ben Affleck Is Done Playing Batman and You Won’t Believe the Reason Behind His Decision

There are a handful of actors who can give life to iconic superheroes so effectively that it is impossible to separate...

March 8, 2020 -

`

Every Interesting Thing You Need to Know about Game of Thrones Star Nikolaj Coster-Waldau

You may know him as the bad-turned-good-turned-bad-again Jaime Lannister in the hit HBO thriller series Game of Thrones, but do you...

March 8, 2020 -

`

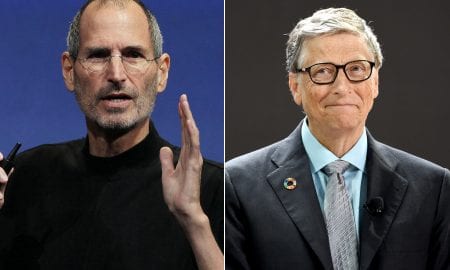

This Man Eavesdropped on Steve Jobs and Bill Gates and What He Heard Changed His Life

In one equation, Steve Jobs was the savior of tech giant Apple and the bad guy is John Sculley, the former...

March 6, 2020

You must be logged in to post a comment Login