An Economic Recession is Around the Corner, Here Are 2 Ways You Can Protect Your Wealth

No one had anticipated at the beginning of the year that 2020 would be so rough. From the Australian wildfires to the COVID-19 pandemic, the new decade has presented a set of unprecedented challenges that have brought the global economy to a screeching halt.

The coronavirus epidemic has definitely left everyone scared, not just about their physical health, but also their financial wellbeing. The signs of stress are already starting to show in the stock market as investors go into a buying frenzy, forcing the economy to the brink of a recession similar to the crash in 2008 which cost so many people their jobs, savings and even homes.

The coronavirus epidemic has definitely left everyone scared

But a stock market crash should not be a reason to panic over your retirement fund, because historically speaking, the values always come back up sooner or later. However, there are certain steps you can take to protect yourself in a time of crisis and make sure that your investments are secure.

Don’t Change the Strategy

It’s understandable that you’d want to change your investment strategy once the market takes a downturn, but resist the temptation and stick to your original plan. There will be people who will try to sell off their stocks to invest in gold or currency instead, whereas others will try to buy more stocks while they are still valued at a low price, but financial advisors advise that you stay put in your investment strategy and don’t deviate from it.

It’s understandable that you’d want to change your investment strategy once the market takes a downturn

Need More Cash?

One of the biggest characteristics of an economic recession is sudden inflation that can leave you struggling to cope with increased mortgage payments. Even though low interest rates might tempt you into taking out more loans, financial advisors suggest holding on to your cash and not putting it towards another downpayment or car loan. Even with an emergency fund and a stable career, it always gives a peace of mind to have some extra cash lying around to cover any unexpected expenses.

financial advisors suggest holding on to your cash and not putting it towards another downpayment or car loan

Times in recession can be quite unpredictable so one should always be prepared for the worst. Maintain a certain level of liquidity to make sure that you’re not dipping into your emergency fund or your investment portfolio when in need of some extra cash. There’s nothing worse than having to sell off some of your investment at a loss because you aren’t able to meet your living expenses.

More in Lifestyle

-

`

Billionaire Mark Cuban Has Learned More from His Failures Than Success, Proving It’s Okay to Make Mistakes

Shark Tank fans must know Mark Cuban as the casually-dressed billionaire who gained his massive fortune and financial success from wise...

March 29, 2020 -

`

Before the Glitz and Glamour: Yolanda Hadid’s Rough Past Will Inspire You To Persevere

Long before supermodels Gigi and Bella Hadid dominated runways, their mother Yolanda was the first to have carved her name in...

March 28, 2020 -

`

As Government Enforces Lockdown, 800,000 Businesses in UK at Risk of Going Under

The COVID-19 pandemic has been the biggest blow to the economy since the 2008 recession, and many fear that its effects will...

March 18, 2020 -

`

These Celebrities Earn Millions Despite Retiring from Hollywood, But How?

While being a celebrity usually comes with million-dollar paychecks, fame is not forever. No wonder, a lot of actors and musicians...

March 8, 2020 -

`

This Gas Station Chain is Making Money Through Unique Ways and Here’s What Entrepreneurs Can Learn from It

There are plenty of business advice to be found both online articles and published books. But there’s nothing quite like seeing...

March 8, 2020 -

`

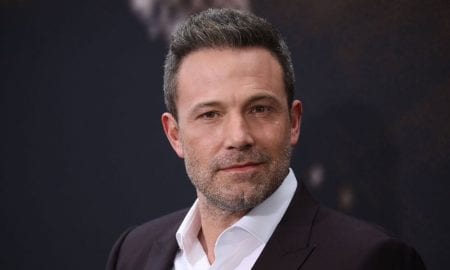

Ben Affleck Is Done Playing Batman and You Won’t Believe the Reason Behind His Decision

There are a handful of actors who can give life to iconic superheroes so effectively that it is impossible to separate...

March 8, 2020 -

`

Every Interesting Thing You Need to Know about Game of Thrones Star Nikolaj Coster-Waldau

You may know him as the bad-turned-good-turned-bad-again Jaime Lannister in the hit HBO thriller series Game of Thrones, but do you...

March 8, 2020 -

`

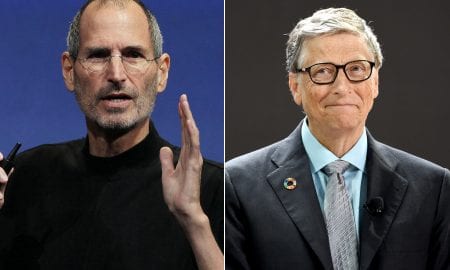

This Man Eavesdropped on Steve Jobs and Bill Gates and What He Heard Changed His Life

In one equation, Steve Jobs was the savior of tech giant Apple and the bad guy is John Sculley, the former...

March 6, 2020 -

`

Federal Reserve Lowers Interest Rates Amid Covid-19 Chaos, Here’s How That Can Affect You

The 2019 novel coronavirus, also known as Covid-19, is a worldwide problem that prompted states to resort to drastic measures. In...

March 6, 2020

You must be logged in to post a comment Login